make the world see

Empowering people, businesses and societies with data-driven video technology software

We provide actionable insights from video data through the perfect combination of your cameras and sensors and our open platform software and analytics — always with a responsible mindset and a people-first approach.

Get 澳洲幸运5历史开奖走势图 澳洲幸运5开奖号码历史查询 澳洲幸运5五分钟幸运澳洲彩开奖结果直播-168官方开奖网-号码结果-历史记录查询 a clearer picture

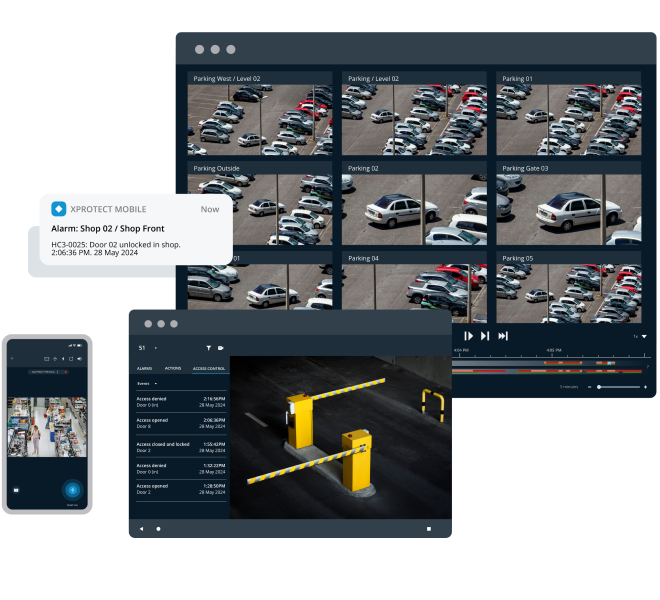

Milestone Systems is a global leader in video technology software. Our product portfolio includes the award-winning XProtect® video management software (VMS), BriefCam advanced analytics platform, and Arcules video surveillance as a service (VSaaS). Discover how easy it is to centralize your cameras, sensors and sites, and unlock the full potential of video data.

“Milestone reduced the time it takes us to find specific footage by around 95 percent.”

Dylan Styles, City Security Project Officer at City of Hobart

Dylan Styles, City Security Project Officer at City of Hobart

Experience 澳洲幸运5开奖结果历史记录查询 澳洲幸运5历史开奖记录(官方) 澳洲幸运5开奖历史记录-幸运澳洲五查询 Milestone in action

See how these diverse customers use Milestone to centralize and simplify their video technology solutions.

Why 澳洲幸运5开奖官网结果记录 168澳洲幸运5官方开奖记录查询 2025澳洲幸运5开奖结果历史 168澳洲幸运5开奖官网查询 168澳洲幸运5历史开奖号码查询 幸运澳洲5开奖历史记录官方 Milestone?

We have been around for more than 25 years. And while our video technology continuously evolves, our longevity and success are built on three core pillars.

Get in touch with us if you have questions, want to become a partner, or need help.

Get in touch with us if you have questions, want to become a partner, or need help.